Mapping the market shows a substantial decline in affordable housing supply in Sydney and Melbourne over the past five years

CoreLogic recently released the June 2017 Mapping the Market Report. The report looks at how the cost of housing has shifted across Australia’s capital cities by suburbs over the past five years by comparing thematic maps which show suburb median values. Over the five years to June 2017, there has been a significant decline in the number of suburbs with a median value below $400,000 while there has been a significant increase in suburbs with values above $1 million. The decline in lower value housing and rise in more expensive housing is most prevalent in Sydney and Melbourne however, it is also prevalent to a more moderate degree in other capital cities.

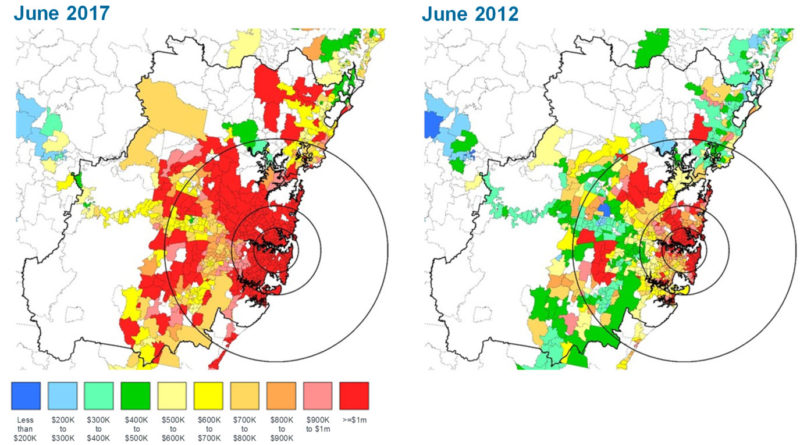

The following maps show the suburb median house values across the capital cities in June 2012 and June 2017. The circles on the map represent distances of 10 kilometres, 20 kilometres and 50 kilometres from the capital city GPO. For this blog we are only focusing on the housing market however, the full report does also include similar maps for units.

Sydney houses

In June 2012, 21.3% of Sydney suburbs had a median house value of more than $1 million, by June 2017 55.7% of suburbs had a median house value in excess of $1 million while only 8.7% of suburbs had a median value below $600,000 and most were located more than 50 kilometres from the CBD.

Melbourne houses

In June 2012, 9.5% of Melbourne suburbs had a median house value in excess of $1 million and by June 2017 that figure had increased to 32.6% of suburbs. On the flip-side, 24.3% of Melbourne suburbs in June 2012 had a median house value below $400,000 compared to just 2.7% by June 2017.

Brisbane houses

In June 2017 only 5.9% of Brisbane suburbs had a median house value of more than $1 million compared to 1.6% in June 2012. In June 2017, 23.2% of suburbs had a median house value of less than $400,000 compared to 34.5% in 2012.

Adelaide houses

In Adelaide, 43.0% of suburbs had a median house value of less than $400,000 in June 2012 compared to 25.8% in 2017. 37.2% of Adelaide suburbs had a median house value of more than $600,000 in June 2017 compared to 20.6% five years earlier.

Perth houses

7.8% of Perth suburbs had a median house value of more than $1 million in June 2012 compared to 11.1% by June 2017. Only 17.7% of Perth suburbs had a median house value of less than $400,000 in June 2017 and this figure was down from 29.0% five years earlier.

Hobart houses

In June 2012, the majority (67.4%) of Hobart suburbs had a median house value of less than $400,000 however, by June 2017 43.6% of suburbs had a median below $400,000. Although the number of suburbs with typical values below $400,000 has reduced over the past five years, 89.4% of the cities suburbs have a median house value below $600,000 and no suburb has a median value in excess of $1 million.

Darwin houses

Darwin has suffered through a lack of more affordable housing for a number of years now with only 1.8% of suburbs having a median house value below $400,000 in June 2017, down from 1.9% five years earlier. 54.5% of Darwin’s suburbs had a median house value of more than $600,000 in June 2017 compared to 50.9% five years ago. The data highlights that Darwin housing affordability is relatively unchanged over the past five years.

Canberra houses

In June 2012, just 1.1% of suburbs in Canberra had a median house value of less than $400,000, by June 2017 no suburbs sat below the $400,000 threshold. The proportion of suburbs with a median value of more than $1 million has shifted from 8.6% in June 2012 to 12.0% in June 2017.

The charts and commentary highlight how the supply of affordable housing has reduced over the past five years. The decline in lower priced housing stock is most stark in Sydney and to a lesser but still significant degree in Melbourne. The fall in mortgage rates over the past five years has made servicing mortgage debt easier and eat up a lower proportion of household income. At the same time there has been little growth in household income but dwelling value in Sydney and Melbourne in particularly have increased significantly. For those that own a home and have seen values rise it has created a significant wealth boost while for potential buyers, particularly in Sydney and Melbourne, wages haven’t kept up with value growth which has led to a deterioration in the supply of lower priced housing. All of these factors have led to extreme difficulty in saving a large enough deposit to enter into the Sydney and Melbourne housing markets for those that don’t already own. While the problems are not so prevalent elsewhere, across all cities the supply of lower priced housing has reduced over the five years to June 2017 highlighting greater difficulty for lower income households to own residential property.

Source: CoreLogic Feed