Trademark Registration and Trademark Renewal – What You Need to Know

A. What is the Best Type of Business Cooperation Agreement / Arrangement?

Are you entering into business cooperation agreement with others? If so, have you thought about what type of cooperative agreement you should have (joint venture or partnership)? We are here to provide you with some guidance and templates on the right form of cooperation agreement for your business.

B. What is the Difference Between a Joint Venture and a Partnership?

They are both commercial arrangements between two or more parties to cooperate in a business venture to share resources, risks and rewards.

Joint Ventures come in all shapes and sizes, which can be set up via a separate corporate entity or just by a simple contract.

Partnerships are a type of Joint Ventures set up by contract. It is not a separate entity and such formal arrangement is recognised by law (except for limited liability partnership, see below).

Whilst partnerships may be regarded as a subset of joint ventures, the main differences are:

- a joint venture can be for a single project whereas a partnership is usually intended for a longer-term continuous business arrangement;

- the liabilities of the parties under a joint venture is usually limited whereas under a partnership may be unlimited; and

- a joint venture is usually conducted as a separate legal entity, whereas a partnership is typically a see-through structure which is arguably more tax efficient.

C. Joint Venture

1. What is a Joint Venture?

A Joint Venture is a cooperation agreement between multiple parties to pool their resources (capital, intellectual property, other assets and capabilities) and share ownership, governance, returns and risks of such business venture.

2. Types of Joint Ventures

Joint Ventures can be categorised into a few forms, with the most common ones are:

- Corporate / Equity Joint Ventures; and

- Contractual Joint Ventures

Let us dig into their differences right away!

3. Corporate / Equity Joint Venture

A Corporate / Equity Joint Venture is the most common form for a Joint Venture to carry on an ongoing basis. An equity joint venture is an agreement between the parties to enter into a business together by contributing equity into a corporation. The equity joint venture is a separate legal entity and is usually incorporated as a limited liability company to shields its shareholders from liability.

Company Limited by Shares

The most common form is a company limited by shares. It is usually a private company, or its equivalent in the relevant jurisdiction unless a subsequent public offering of shares is contemplated.

Unlimited Company

An unlimited company may have tax advantages in some jurisdictions. Each member of an unlimited Company has unlimited liability and, in certain circumstances, the company is exempt from requirements to file publicly any annual amounts.

Corporate / Equity Joint Venture Advantages and Disadvantages

With a corporate personality, the Corporate Joint Venture can do anything a natural person could do, including the ability to enter into contracts and hold property in its own, rather than looking through to the shareholders. A Corporate / Equity Joint Venture generally offers the following Advantages:

- Corporate personality

- Continuity in the event of transfers

- Limited liability for shareholders for limited company

- More opportunities for financing

- Flexibility of share rights

- Established laws

- Recognised in most jurisdictions, suitable for international business

However, parties looking at a one-off project may shy away from this business structure due to the following Disadvantages:

- Formality and registration

- Compliance requirements

- More difficult to get out if things do not work out (need to wind up the company)

As such, parties who are cooperating on a single project short term may prefer to enter into a Contractual Joint Venture agreement instead.

4. Parallel Joint Venture

In an international Joint Venture, there may be occasions when it is preferable to establish a different Joint Venture vehicle in different countries – rather than a single Joint Venture Company to act as holding company for a number of subsidiaries located in different jurisdictions. This is often determined by tax factors.

5. Contractual Joint Venture

Contractual Joint Ventures are established as unincorporated ventures based simply on a contract between the parties detailing their cooperation, without the creation of an independent legal entity.

A Contractual Joint Venture is usually more appropriate for short-term, single-purpose ventures or those established for cost-sharing purposes (e.g. collaboration on joint R&D or a consortium to undertake a particular works project). Remember to draft the contractual provisions in detail as the business relationship depends primarily on them!

6. What do I need to consider before choosing the type of Joint Venture?

Before entering into a Joint Venture agreement, plan ahead by asking yourself these questions:

- What are your primary commercial objectives?

- What interests do you want to protect? (control, exit, intellectual property rights, dividend returns, etc)

- How do you expect to make a commercial return from the Joint Venture? (dividends, payments under ancillary contracts, capital gains on exit, etc)

- What rights of control or participation do you expect?

- Do you need an exit strategy?

For more information on drafting a Joint Venture Agreement, please refer to the link below.

For an example of a contractual joint venture agreement, please refer to:

2-party Joint Venture Agreement.

D. Partnership

1. What is a Partnership?

A Partnership is a formal arrangement between multiple parties to share its management and profits. Every Partner must render information to any partner. Every Partner must account to the firm for any benefit derived. Basically, a Partnership is a fiduciary relationship between Partners who owe a duty of good faith towards each other.

2. Types of Partnership

There are typically 3 types of partnership:

- General Partnership

- Limited Partnership

- Limited Liability Partnership

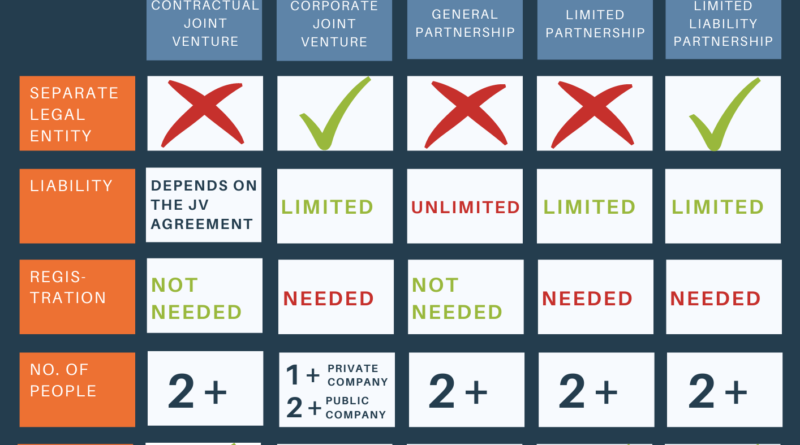

The main difference between the 3 types of partnerships relates to the liability of the partners, which we shall explain below.

3. General Partnership

A general partnership is a business cooperation agreement whereby a number of general partners agree to share in all assets, profits, and financial and legal liabilities of the partnership. Its primary feature is that the general partners are equally responsible for the business and would all have unlimited liabilities for the debts of the General Partnership.

General Partnership Advantages and Disadvantages

General partnerships are fiscally transparent for tax purposes. In other words, profits and losses are accrued directly to the partners in their respective shares. General Partnership has multiple Advantages:

- More tax-efficient than a separate corporate entity

- Less formality in creation and management

- Fewer restrictions on capital flow

- Flexibility

- Recognised in most jurisdictions, suitable for international business

However, General Partnership also has the following Disadvantages:

- Lack of a separate legal entity

- Lack of certainty, especially when the parties do not document the arrangement as a conventional partnership

- Joint and unlimited liability for debts and obligations of the Partnership

For a sample general agreement template, please click the links below:

2 Parties General Partnership Agreement

4 Parties General Partnership Agreement

4. Limited Partnership

It is not uncommon for a partner to decline to enter into Partnership Agreement even in a win-win situation due to the potential unlimited liability. How can we mitigate that? One alternative is to opt for a Limited Partnership. Please note that a Limited Partnership is different from an LLP (see below).

A Limited Partnership may exist of Limited Partners (with limited liability) with at least one General Partner (with unlimited liability). A Limited Partner will lose the benefit of limited liability if it becomes involved in the management of the Partnership. Other than these, it has similar features as a General Partnership.

A Limited Partnership is commonly used as a private equity vehicle with the investment manager as the general partner and investors as limited partners. It is transparent from a tax perspective whilst limiting the liability of the investors.

For an example of a Limited Partnership Agreement, please click the link below:

2 Parties Limited Partnership Agreement

5. Limited Liability Partnership

A Limited Liability Partnership (LLP) is a type of partnership with separate legal personality and limited liability. It is a hybrid of partnership and company.

What is a Limited Liability Partnership?

A Limited Liability Partnership is a new form of legal entity created through statutes in a number of common law jurisdictions, e.g. the UK. All dealings between Partners are governed by a Membership Agreement. It was developed to combine the benefits of limited liability with the flexibility of a partnership structure. Limited Partnership Advantages and Disadvantages

Advantages of a Limited Liability Partnership (LLP):

- Corporate personality

- Separate legal standing

- Tax transparent (advantage of a Partnership)

- Limited liability (advantage of a Limited Company)

- Organisational flexibility

- Compatibility with any type of business

Disadvantages of a Limited Liability Partnership (LLP):

- Increased formality such as registration and public filing requirements

- When there is only 1 member for more than 6 months, limited liability is no longer available and the continuing member takes on personal liability for the LLP

With so many advantages, no wonder it is increasingly popular among entrepreneurs! Click here to view a 2-party Limited Liability Partnership (LLP) Agreement Template and create your own now!

6. What is the Difference between Different Types of Partnerships?

In a General Partnership, all partners are responsible for the liabilities of the partnership, which are unlimited.

In a Limited Partnership, the liability of limited partners is limited and that of the general partner is unlimited.

In a Limited Liability Partnership (LLP), even though it is under a partnership structure, it is a separate legal entity with limited liability.

For more details on the difference between different types of partnerships, please see the link below: Partnerships Explained

7. Which Partnership Structure should I use?

Once you have decided to opt for a Partnership, ask you and your partner(s) will need to consider the following actors, in order to prepare yourself and a comprehensive Partnership Agreement:

- Liability: Are you prepared to bear credit risk for each Partner? Would one or more partners prefer limited liability?

- Tax: Do you prefer tax transparency or having a LLP as a separate entity similar to a corporate venture?

- Management: What management model would you like to use? How should each Partner participate in the management?

- Profits/losses: How should the profits/losses be distributed? Are Partners obliged to contribute financially to fund any loss?

- Implied terms: If you are creating a Partnership in certain common law countries (e.g. the UK), there are certain statutory regulations which imply a number of terms, such as a 5% per annum loan to the Partnership. Make sure you expressly exclude any unwanted terms.

- Competition / Regulatory Laws: Would the partnership be in breach of any statutory restrictions under competition/regulatory laws?

- Accounting treatment: If partners are from different countries, which country’s accounting standards should be followed? What about the accounting year?

- Employment structure: Which entity would be hiring the employees? Any transfer of employees from the partners to the partnership? Who would the employees be reporting to?

- Formalities of formation and publicity/administrative requirements: Any registration required? Registration is usually required for limited partnership and LLP in most jurisdictions.

- Transfer of Interests: What are the procedures of subsequent transfers of interest to third parties, or the introduction of new shareholders?

- Ease of unwinding: If things do not work out, how easy is it to unwind the partnership and revert back to the original positions of the parties?

E. Things to consider before entering into a Cooperation Agreement

The legal structure of your cooperation must be agreed and established early. It significantly affects the choice/use of lawyers and the drafting of the documents. It is vital to identify the requirement of establishing the cooperation structure you choose.

One should establish a realistic timetable for negotiation amongst the parties and obtaining the third-party consents or undertaking. Once the cooperation structure has been agreed, the following are 9 additional items one will need to consider when drafting the cooperation agreement:

1. Competition / antitrust

Joint Ventures frequently require regulatory approval. It is vital to review at an early stage the likely regulatory impact on any venture. Regulatory approvals can include:

- Merger control: Notification or approval may be required under the statutory regulations or national merger controls.

- Foreign investment controls: In many countries, particularly in emerging markets, participation by a foreign company will require prior approval under foreign investment laws of the “local” jurisdiction.

2. Industry-specific approvals

Many industries are regulated (often through a licensing procedure) in relation to the admission or conduct of participants engaged in those industries, such as banking, insurance, financial services, utilities; broadcasting, telecommunications, etc. 3. Stock Exchange/shareholder approval

A company (particularly one whose securities are quoted on a public stock exchange) will need to consider whether the establishment of the particular venture requires prior approval from its shareholders and/or involves mandatory notification requirements.

4. Financing/borrowings

Will the venture involve a transaction which requires the prior consent of banks or trustees under the terms of any loan agreements, debenture stocks or trust deeds?

5. Major contracts/customers

As a commercial matter, it will often be important for the parties to gain comfort that major existing customers or suppliers will continue to deal with the Joint Venture or the Partnership. In addition, the creation of a new business entity may mean that the consent of counterparties to relevant contracts is required, involving a need to distinguish between:

- Major contracts where the consent of the counterparty (including, possibly, partners in other material joint ventures) is of such importance that it should be a condition precedent of the joint venture going ahead

- Contracts where the counterparty’s consent (at least in principle) is advisable in order to vest the legal rights and obligations fully in the new joint venture entity

- Contracts which technically require counterparty consent but where it is not considered practicable or necessary to seek those consents.

6. Employees

Key timing and/or political issues can arise from any requirement for consultation with employees or trade union representatives under any employment legislation or under any local agreements. Consultation requirements can be particularly time-consuming in many continental European jurisdictions. These requirements need to be identified and planned at an early stage. 7. Valuation of non-cash assets

If the venture is to be founded on the contribution(s) of non-cash assets, many jurisdictions require formal procedures for the valuation of those assets. If so, these procedures need to be identified early and built into the timing.

8. Disposal/Acquisition

Where the Joint Venture/Partnership involves the merger of significant businesses/assets to be contributed by each of the parties, the transaction raises a number of issues equivalent to those in any private acquisition/disposal transaction.

Particular issues which frequently arise in a Joint Venture/Partnership transaction include:

- What business/assets are being contributed? What contribution is each party making in terms of assets, business, services, technology and people? In many cases, it may be a significant exercise to clarify the scope of the business to be contributed – particularly where this is not in a self-contained corporate entity.

- Shares or assets or both? This affects the type of documentation required to contribute the shares/assets – and often the approach to the issue of responsibility for pre-merger liabilities.

- Due diligence. Due diligence is often necessary, and take a similar form, as in an acquisition – arguably, it is even more important since it will be difficult commercially, except in extreme situations, to pursue a legal claim for breach of warranty against a joint venture party after the joint venture has commenced.

- Valuation. Have appropriate valuation mechanisms been agreed to establish the respective “value” to be attributed to each party’s contribution? This may become a major commercial negotiation. In some transactions, it will be appropriate to involve outside financial advisers to assist in the complex and sensitive negotiations.

- Value equalisation. Where the parties wish to retain a 50:50 equity split or other fixed equity ratios, a task is to agree on mechanisms to “equalise” the valuation gap. For example, one party may have to transfer a certain amount of money to another party to equalise their contributions.

- Warranties/indemnities. Warranties/indemnities should generally be restricted to significant matters affecting the other party’s contribution or the financial performance of the venture. Warranties will usually be subject to limits as to time and amount, often including a relatively high floor to discourage small inter-party claims.

- Intellectual property/technology. Technology is at the heart of many businesses. What rights are going to be contributed to the Joint Venture/Partnership? Will the parties retain ownership to exercise intellectual property rights outside the scope of the Joint Venture/Partnership? Will they receive licences for use of intellectual property rights developed by the Joint Venture/Partnership itself? What are the rights of the parties on termination and transferral of intellectual property rights?

9. Country/Jurisdictional Requirements

A Joint Venture/Partnership must be founded in the jurisdiction of one country and the national laws (and practice) is important to the establishment of that Joint Venture/Partnership.

Issues which commonly arise include:

- Are a foreign investment or other governmental/regulatory approvals required?

- What documentation or procedure is involved?

- Are central bank restrictions or approvals required?

- Are there restrictions on foreign participation (including as to the permitted percentage size of any shareholding) in the relevant industry?

- Are there specific requirements for third party valuation of non-cash assets?

- Will documents require to be notarised? will they need to be in the local language?

If you want to explore a new market opportunity in a foreign country, make sure you seek legal advice from local lawyers of that jurisdiction.

F. Cooperation Agreements Templates

DOWNLOAD FOR FREE: Joint Venture Agreement

An unincorporated Joint Venture/Consortium Agreement with a Joint Venture leader and participants to provide service to a client in a particular jurisdiction. The association is for non-permanent services required for a specific project. This agreement is drafted for 4 parties and can be in Neutral Form, with full or no indemnity between participants.

DOWNLOAD FOR FREE: Shareholders Agreement

A Shareholders Agreement suitable for the set up of a relatively simple joint venture – a company with equal shareholding. This agreement is drafted for 4 parties and can be in Neutral, Strict or Loose Form.

DOWNLOAD FOR FREE: General Partnership Agreement

A General Partnership established under local laws. It provides a basic Partnership framework only. This agreement is drafted for 4 parties and can be in Neutral, Strict or Loose Form.

DOWNLOAD FOR FREE: Limited Partnership Agreement

A Limited Partnership established under local laws. It provides a basic Partnership framework only. This agreement is drafted for 4 parties and can be in Neutral, Strict or Loose Form.

DOWNLOAD FOR FREE: Limited Liability Partnership (LLP) Agreement

A Limited Liability Partnership (LLP) established under local laws. It provides a basic Partnership framework only. This agreement is drafted for 4 parties and can be in Neutral, Strict or Loose Form.