Buyer demand moves off the floor in mining regions

Most mining towns have seen their property prices crushed over recent years as commodity prices have fallen and investment has dried up. In this week’s Pulse we take a look at how some of these major mining regions are faring.

As resource investment has stalled over recent years, demand for housing in towns linked to the mining and resources sector has fallen which has dragged house prices lower. More recently many of these towns have seen sales volumes begin to lift and in some regions there are signs that the rate of decline in house prices are starting to slow. This leads to the question as to whether the worst of the price falls in these areas are now in the past?

History has shown that mining booms don’t last forever and it would be difficult to find anyone that could suggest the house prices in many of these towns were sustainable during the boom. Prices were being driven higher by a temporary influx of residents on high incomes creating greater housing demand at a time in which supply which was largely irresponsive which drove prices to record high levels. As the demand subsided supply was beginning to increase which led to substantial falls in both prices and sales.

In the following section we highlight some of the key statistics for house prices in the selected mining and resource related regions of Australia.

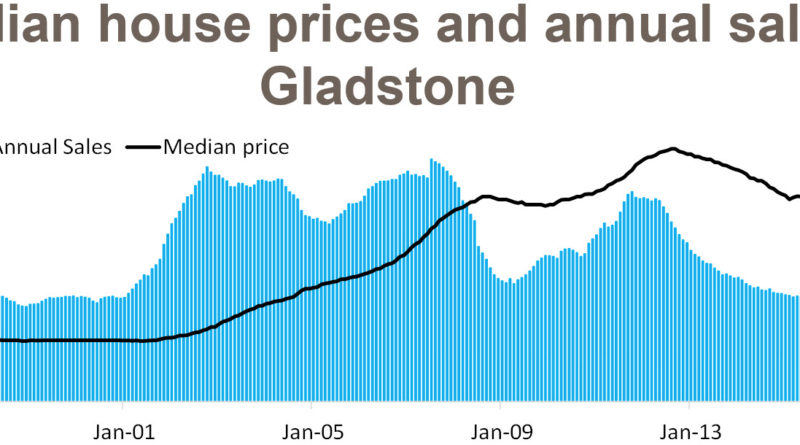

Gladstone – 578 sales over the past year at a median price of $323,875. Sales volumes are 68% lower than their July 2007 peak and median prices are 32% lower than their September 2012 peak.

Mackay – 1,216 sales over the past year at a median price of $335,000. Sales volumes are 63% lower than their April 2004 peak and median prices are 23% lower than their June 2013 peak.

Isaac – 198 sales over the past year at a median price of $140,000. Sales volumes are 70% lower than their March 2012 peak and median prices are 77% lower than their November 2012 peak.

Port Hedland – 204 sales over the past year at a median price of $300,000. Sales volumes are 49% lower than their July 2006 peak and median prices are 67% lower than their June 2013 peak.

Karratha – 289 sales over the past year at a median price of $285,000. Sales volumes are 44% lower than their March 2005 peak and median prices are 65% lower than their October 2010 peak.

Roxby Downs – 31 sales over the past year at a median price of $225,000. Sales volumes are 83% lower than their December 2003 peak and median prices are 55% lower than their October 2013 peak.

While each of these markets has recorded a significant fall in sales and selling prices over recent years, more recently each market has started to see sales rise. While this is unlikely to represent demand substantial enough to drive prices higher it may be enough to slow or stop the declines in prices.

It should also be remembered that it is not as if there is no demand for housing in these towns, it is just that demand is substantially lower than it was during the mining boom. Someone looking to purchase now is securing a property at a substantial discount from previous highs however, these towns also continue to achieve some of the best rental returns based on current pricing and rents. While we expect very little prospects for capital growth over the coming years, investors looking for a passive income may be becoming more attracted to these market which could explain the recent uptick in sales.

Source: CoreLogic Feed