High-rise unit approvals have fallen off a cliff

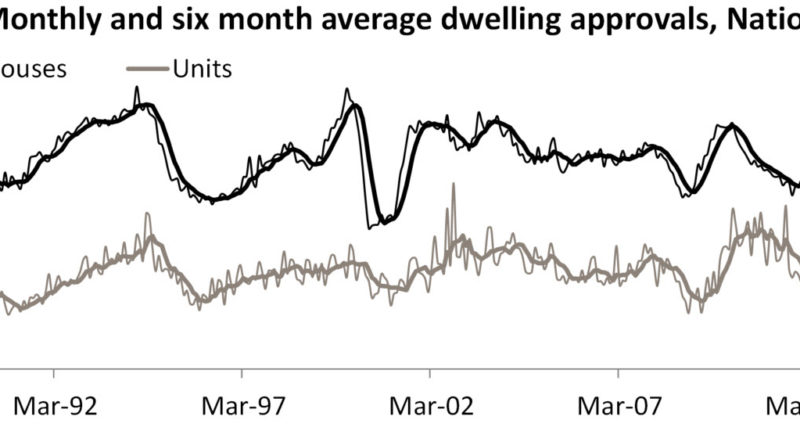

Monthly building approvals shows that the recent contraction in approvals has continued. In fact, the number of dwellings approved for construction in March 2017 was -23.7% lower than its historic peak which occurred in August of last year. The data now clearly looks like a case of what goes up must come down and the high-rise unit sector in particular has seen a big crunch in approvals over recent months.

The March 2017 approvals data shows that there were 16,484 dwellings approved for construction over the month which was -13.4% lower than the previous month and -19.9% lower than a year ago. It was the fewest approvals over a month since October 2016 and the second lowest monthly number of approvals in 30 months. The 16,484 approvals consisted of 9,074 approvals for houses and 7,410 approvals for units. Houses and unit approvals are lower over the month (-5.0% and -22.0% respectively) and year (-11.6% and -28.1% respectively). Throughout this current cycle the cyclical high for house approvals was recorded at 10,706 approvals in April 2015 and unit approvals reached an historic high in August 2016 at 11,953 approvals. March 2017 approval volumes were -15.2% lower than their cyclical peak for houses and -38.0% lower than their historic peak for units. The data certainly points to the fact that the construction boom we are currently experiencing has come to an end.

High-rise unit approvals are driving the slowdown in approvals. The ABS defines high-rise units as anything of four storeys or higher as opposed to low-rise unit (less than four storeys) and townhouses. As the above chart shows, there has been a substantial decline in high-rise unit approvals lately with just 2,664 approvals nationally in March 2017. This represents the fewest monthly high-rise unit approvals since June 2013. High-rise unit approvals have accounted for as much as 74.2% of all unit approvals in July 2016 however, in March 2017 they accounted for 38.4% of all unit approvals. For the first time since May 2013, there were more townhouses (2,812) approved for construction. There has also been an uplift in low-rise unit approvals over the month. The shift away from high-rise unit approvals to low-rise and townhouses can be seen as reducing the risk in some of these off-the plan projects. High-rise development ultimately means more units to sell and thus greater construction in settlement risk. Townhouse and low-rise construction projects have fewer individual units and as a result are likely to mean lower levels of risk for both developers and financiers.

Capital city data shows that there were 13,073 dwellings approved for construction in March 2017. This figure consisted of 6,789 houses and 6,284 units, in fact, it was only the second time in 30 months that across the capital cities there were more houses approved for construction than units. House approvals were 11.0% higher over the month and 2.6% higher year-on-year while unit approvals were -13.1% lower over the month and are -27.7% lower year-on-year.

Monthly data shows that Brisbane was the only capital city to not record more house approvals over the month, falling -0.5% while Darwin house approvals were unchanged. While most cities recorded a monthly increase in house approvals, each of Sydney, Melbourne, Perth and Darwin recorded fewer unit approvals over the month. In fact, the 2,222 unit approvals in Sydney were the fewest since January 2016.

Units have comfortably accounted for the majority of dwelling approvals in most capital cities over recent years however, in March 2016 only Sydney and Canberra recorded a majority of approvals for units. In all capital cities except for Canberra and Hobart unit approvals are now trending lower further pointing to a fading away of the unit construction boom seen over recent years.

While housing construction has contributed a lot to the country’s economic performance over recent years, the recent building approvals data clearly points to a looming slowdown in housing construction. This is going to be particularly felt in the high-rise unit sector where the slowdown has been dramatic over recent months. Over the coming months we expect further weakness in approvals which will work its way over the coming quarters and years to fewer commencements and completions. From an economic perspective, Governments will need something to fill the gap from the substantial stimulus and job creation created by the housing construction sector over recent years. Tomorrow’s Federal Budget hopefully will reveal what those sectors might be; however there is a strong chance that a surge in transport related infrastructure development will fill some of the hole.

Source: CoreLogic Feed